Life Insurance in and around Myrtle Beach

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Myrtle Beach

- North Myrtle Beach

- Horry County

- Surfside Beach

- Conway

- South Carolina

- Georgetown

- Pawleys Island

- Murrells Inlet

- Loris

- Little River

- Longs

- Aynor

- Carolina Forest

Be There For Your Loved Ones

State Farm understands your desire to protect your partner after you pass. That's why we offer excellent Life insurance coverage options and dependable considerate service to help you pick a policy that fits your needs.

Get insured for what matters to you

Don't delay your search for Life insurance

Why Myrtle Beach Chooses State Farm

When it comes to applying for what will work for you, State Farm can help. Agent Yvonne Salsbury can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your current age, how healthy you are, and sometimes even body weight. By being aware of these elements, your agent can help make sure that you get a suitable policy for you and your loved ones based on your specific situation and needs.

To experience how State Farm can help protect your loved ones, call or email Yvonne Salsbury's office today!

Have More Questions About Life Insurance?

Call Yvonne at (843) 213-6226 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

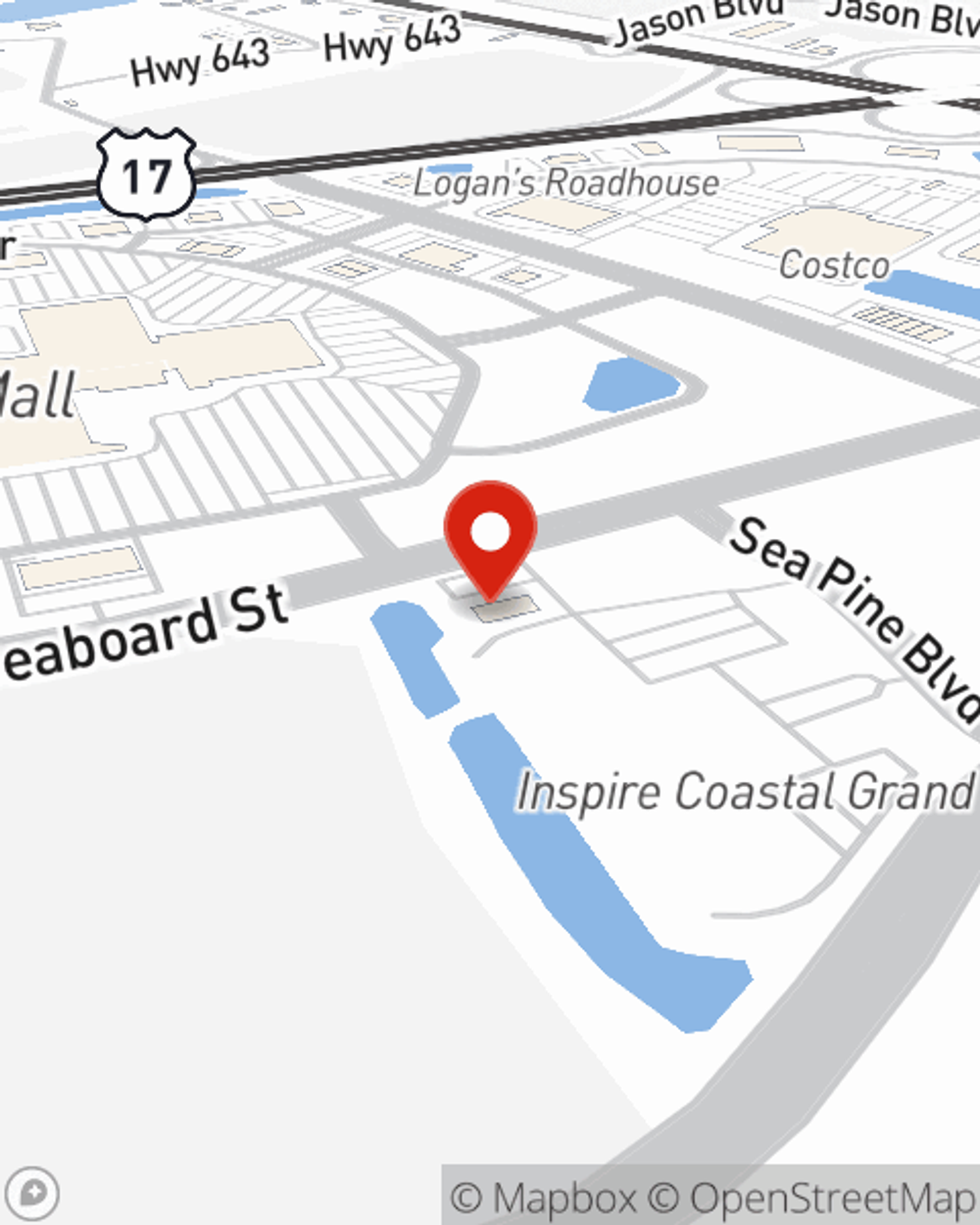

Yvonne Salsbury

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.