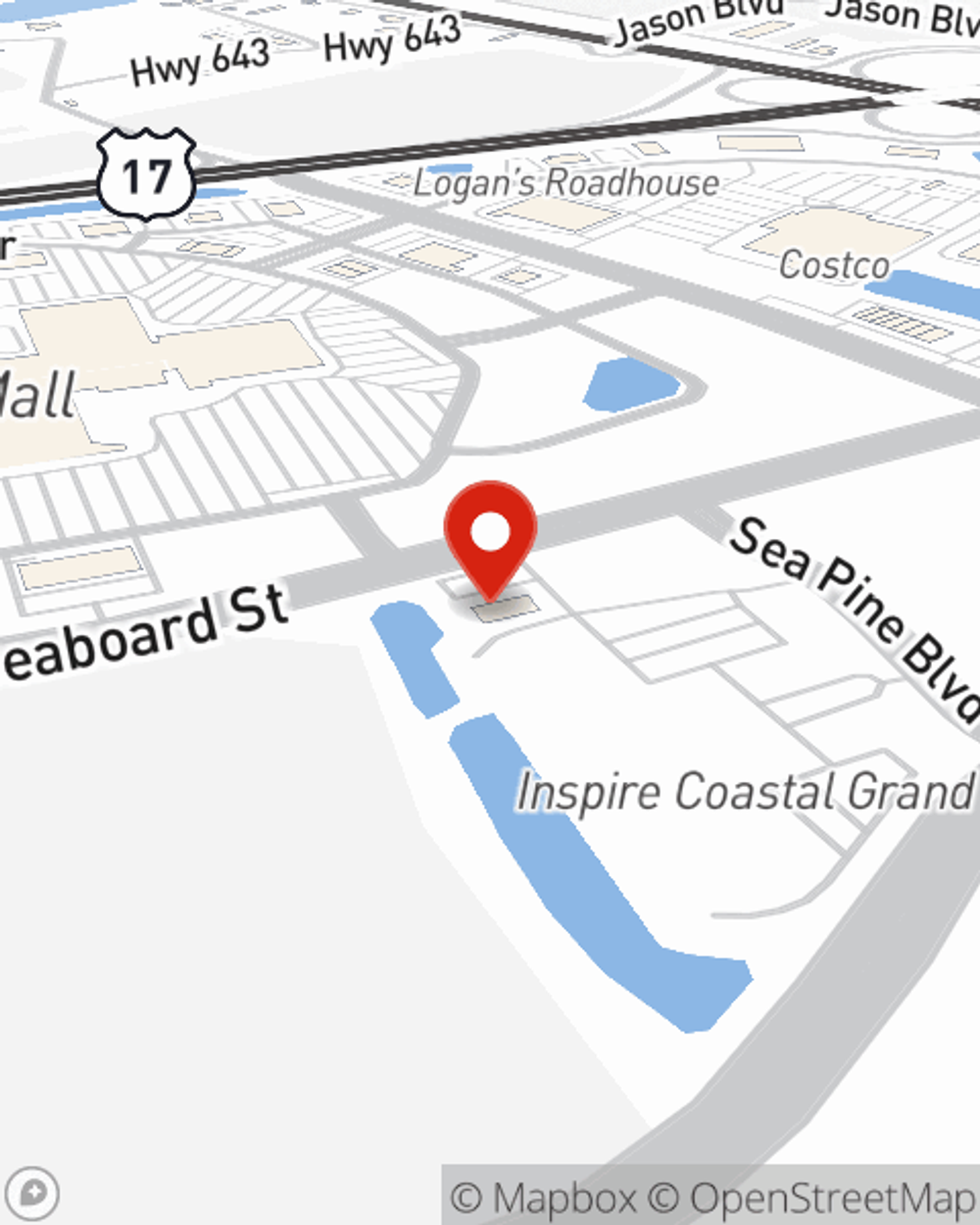

Renters Insurance in and around Myrtle Beach

Looking for renters insurance in Myrtle Beach?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Myrtle Beach

- North Myrtle Beach

- Horry County

- Surfside Beach

- Conway

- South Carolina

- Georgetown

- Pawleys Island

- Murrells Inlet

- Loris

- Little River

- Longs

- Aynor

- Carolina Forest

Calling All Myrtle Beach Renters!

Trying to sift through coverage options and deductibles on top of your pickleball league, managing your side business and work, can be time consuming. But your belongings in your rented house may need the terrific coverage that State Farm provides. So when trouble knocks on your door, your sound equipment, sports equipment and electronics have protection.

Looking for renters insurance in Myrtle Beach?

Your belongings say p-lease and thank you to renters insurance

Safeguard Your Personal Assets

You may be wondering: Is renters insurance really necessary? Just pause to consider how difficult it would be to replace your belongings, or even just one high-cost item. With a State Farm renters policy backing you up, you don't have to worry about windstorms or tornadoes. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Yvonne Salsbury can help you add identity theft coverage with monitoring alerts and providing support.

If you're looking for a dependable provider that can help you understand your options, reach out to State Farm agent Yvonne Salsbury today.

Have More Questions About Renters Insurance?

Call Yvonne at (843) 213-6226 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Yvonne Salsbury

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.